Welcome to MediaReset.com

You’ve arrived at a blog about transforming the companies that publish newspapers. And it’s a blog with an unorthodox point of view.

Here it is: News will not save you.

Why not? Because the disruption that’s pounding newspaper companies is not about people switching their news consumption from print to the web, smartphones, iPads, Facebook, Twitter or anywhere else.

It really isn’t about news at all. It’s far bigger than that. Read the rest of this entry

Some parting words about what our industry needs to do

Folks, this may well be my last post — and I mean to try to land one more punch on the way out.

Folks, this may well be my last post — and I mean to try to land one more punch on the way out.

In the five years since I created MediaReset.com, I’ve tried once a month to serve up to our industry what I had learned and was continuing to learn about how to diversify our declining business and return to growth.

As I look back through the posts I’ve written, I see a rich backlog of ideas, possibilities and perspectives that still apply today, Some of these I was able to bring to fruition in my day job. Some I wasn’t, but I still believe they have important potential.

And now, for a combination of personal reasons, it’s time for me to stop.

Why now?

There are two triggering causes.

First, Morris Communications, where I’ve been director and then vice president of strategy for the last 8 years, has sold its newspapers. (More about why below.)

When the sale process began early this year, my work — trying to find and implement new business strategies and initiatives for Morris Publishing Group — stopped. So I’m no longer trying to explore the margins and frontiers of the business.

Second, I’ll turn 67 in December. Retirement beckons. In January of this year, I reduced my work schedule to four days a week. Now, with the sale of the newspapers, that’s more than the company needs. So I will be reducing my work at Morris still further, going to an on-call consulting basis.

How are we doing?

As I step away from the business that’s been my career, as well as my father’s and grandfather’s, I wish I were more hopeful about its future.

There’s much that a newspaper company can be doing to diversify — to serve readers, advertisers and communities with great new solutions that could produce a growing business. But I see hardly any newspaper companies doing it fast enough to offset the steady decline of the core business.

On the content side, I believe great pioneering work could be done to make us indispensable to large and growing local audiences. But too many of our newsrooms are stuck in the news definitions of the past. See last month’s post for a recap of five years of ideas on what we can and should do to become more relevant.

The problem on the advertising side is less under our control. Now that virtually everyone in our communities is reachable digitally, ads simply don’t need news as a distribution channel. Ads can go wherever their desired audiences are, targeting individual characteristics and behaviors. Our print products and websites are still viable options for advertisers, but there are better choices out there.

We need to be making the advertising and marketing moves today to be viable in the near future, when print advertising will no longer be any business’s preferred choice.

Can digital save us?

The best newspaper companies — and I count Morris Publishing Group among them — have driven themselves hard for 20 years to get their share of the rising local and national spending on digital advertising and marketing.

The trouble is, our digital properties — websites, emails, apps, etc. — are tiny players in the vast digital space. And the digital giants, Google and Facebook, are increasing their already huge dominance.

Several years ago, the leaders in our industry pushed beyond selling only their own digital properties to selling everyone else’s, too. In our markets, we need to be the absolute best of all contenders at putting a business in front of the right potential customer, through all the most effective channels.

We can’t just be “newspaper companies” any more; we need to be the best digital marketing solutions companies our customers can find.

What should we be doing?

I’ve tried to describe this vision in many ways, and the potential arsenal of solutions we should be offering. To wit:

We could build or grow an ancillary business in events and event marketing.

We can develop digital marketing agencies, as I described here.

We can do all of the following, which I described in the linked posts: e-commerce, content marketing, data marketing, predictive analytics, in-store promotions.

If a newspaper company did all of these, could it reverse the revenue losses and actually start growing? I think it’s a real possibility. Any company that did all of this would have a much broader and more diverse revenue base, including multiple rising trend lines.

The problem is, doing even one of these initiatives requires vision and strong leadership at the top — and a big investment in people, training and technology.

Doing one or two of them seems to be about as much as most of our struggling companies can manage. The best companies might tackle three or four — and it still wouldn’t be enough.

I know this by experience, in the companies where I’ve worked. We’ve tackled as many innovations as we could, and it hasn’t been enough to reverse the declines in the core. Which brings me to the crucial strategy for closing the gap: acquisitions.

Today, many newspaper companies are still generating healthy profits, even though the dollars are shrinking every year. Any owner who is serious about returning to growth simply must plow a big share of those profits into buying related — or unrelated — businesses that are growing.

The acquisitions piece

I described that approach here, with reference to Procter & Gamble — and to Jim Moroney and the Dallas Morning News organization. Jim has been the industry leader at diversification, at least in the United States.

So, with all these strategies, could newspaper owners get those plunging revenue lines to turn upward? I think so.

But will they? I’ve seen enough to believe that most won’t. It’s a very tall order, requiring not only vision, courage and investment, but also scale.

How big is scale?

We didn’t have enough scale at The Monroe News, the single, stand-alone daily paper that my family converted to 100-percent employee ownership. Despite our best efforts to diversify revenues over a decade, we didn’t have enough resources or scale to reverse the trend. So, in 2015, it fell to me as chairman to lead the board in selling the company to GateHouse Media.

And scale is what, ultimately, we didn’t have enough of at Morris Publishing Group. Even with 11 daily papers and a long record of innovation, we weren’t able to reverse the trend. The sale to GateHouse was announced in August and closed at the beginning of October.

If you are an owner or a senior leader in this industry, I have to ask you — are you getting it done? Are you doing enough to offset the decline of the core? Can you? Will you?

In the throes of battle

When you’re fighting the good fight and you’re in the thick of it, it’s easy to believe you’re doing all you can do — and to hope it will be enough.

But if you’re not offsetting your revenue losses, I urge you to think again. Whoever said, “Hope is not a strategy” could have been talking about the newspaper industry today.

If you’re staying in the business, it’s time to double down on diversification — through content innovation, advertising and marketing innovation, and acquisitions beyond the boundaries of our declining core business.

I’ve been preaching this way for 12 years now, and I feel that I’ve done what I could. It started with the Newspaper Next project from 2005 to 2009, in which I taught new innovation strategies to more than 5,000 people in the industry in the U.S. and around the world.

It continued at Morris Publishing Group from 2009 to this year, where I got to explore and help to launch a big handful of innovative programs, products and strategies.

And for the last five years, I’ve done my best to share my learnings through Mediareset.com. I hope you and others have found these posts helpful.

Now, it’s over to you.

I’ll leave my blog up for the indefinite future, so my work here will remain available. And I’m thinking I may write one more post in a month or two, speculating on what might happen a decade or more in the future, if newspaper companies as we’ve known them cease to exist.

Until then, farewell.

To contact me: steve.gray[at]mediareset[dot]com

One more time: Our content is failing our industry

The year was 2005, and the scene was a meeting of the Newspaper Next Industry Task Force — some of the best and most innovative minds in the newspaper business.

In midstream, the brilliant and irascible Lincoln Millstein, then head of digital for the Hearst newspaper group, threw down this challenge (not his exact words, but my best recollection):

“You can’t name any other business that would leave a manager in charge of a product whose sales have fallen every year for the last 30 years!”

He rammed home the point: Newspaper circulation had been falling steadily for decades, and yet newspaper companies had left the same kinds of people in charge of content, doing the same old stuff. When were we going to get serious about changing the content to produce better results?

Amen, Lincoln. I’ve never forgotten your point. It’s as deadly accurate today as it was 12 years ago — and the results keep getting worse.

In this blog, for five years, I’ve written repeatedly about why and how our our content needs to change. We keep acting out that old cliche about insanity — doing the same thing over and over again, expecting different results.

This time, instead of trying to come up with yet another way to say it, I will point back to 13 of my previous posts. Or should I say, 13 previous attempts to open this industry’s eyes to the desperate need for change in content.

Rethinking the mission and purpose of local reporting

Excerpt:

“So we need to start with a different question. Not, “How do we fund journalism?” but “What is the content that local people really want and need?”

“And that points me back to the core purpose of local reporting. It’s not “doing journalism.” It’s providing information every day that meets genuinely felt needs among the people who live in our communities.

“Our purpose should be to figure out what those needs are and go get that information.”

The hardest part of saving news: Changing the definition

The tiny share of web traffic we’re getting with news, what Millennials consider to be news, and a metrics approach that can lead us to more successful content.

Millennials, news and the Borneo effect

How the explosion in available content has reduced the demand for news. With a parable from a friend’s experience in the jungles of Borneo: If you grew up with an infinite supply of every kind of food, how much rice would you eat?

Millennials grew up with access to every kind of information; no wonder they don’t consume a lot of news. And what we should do about it.

The audience game is forever changed; will we change, too?

“The stats (presented here) show that we’re losing the audience game in a big way. So we need to do some hard thinking about which audiences in local markets have the most value and therefore are most worth pursuing.

“Home buyers? Car buyers? Job seekers? Finance, insurance and mortgage customers? What else? Then we need to set appropriate priorities among the most promising target groups and figure which solutions will work best for each of them.”

Media business model: Are you running the Scotch Tape store?

Media business model: Are you running the Scotch Tape store?

How an old Saturday Night Live sketch about the Scotch Tape store at the old mall parodies our business’s relentless concentration on news.

And how, at the “new mall” — the Web — “you can find content directly relating to every big and little interest and concern in your life. You can get content that’s immediately useful in what you’re doing or about to do. Content that’s suited to exactly who you are, to what your life situation is, to what you care about, to what makes you laugh, to what you are considering doing right now. And, with a smartphone in your hand, you can get all of this in seconds, anywhere you are.”

Why the definition of news must change in the digital age

To understand the new landscape, every news person should take up a challenge from magazine blogger Andrew Davis, who said:

I challenge you to put yourself in the shoes of your primary audience. Spend the day consuming the content they consume, visiting the websites they visit. Then, ask yourself what you could do to make your print product more valuable given the experience you’ve just encountered.“

And not just print, of course. We’re a local information franchise, print and digital. To get back to success, we need to start over by understanding the appetites that are driving our desired audiences today.

The big picture: Mass media era was the blink of an eye

Excerpt: “Let’s put it in individual human terms. For 200,000 years, you could get hardly any information about anything. For 150 years, you could get whatever someone decided to print or broadcast. And now, from about the year 2000 on, you can get just about any information you want, from just about any source, wherever you happen to be.”

Excerpt: “On a planet where everyone can get virtually any information, what new models can we discover for engaging their attention, for being indispensable, for supplying information they aren’t willing to live without? And how can we help businesses take advantage of the vast new range of audience-reaching channels and technologies — whether we own them or not — that are penetrating every waking moment of human consciousness? And get paid for it?”

Desperately needed: More innovation on the audience side

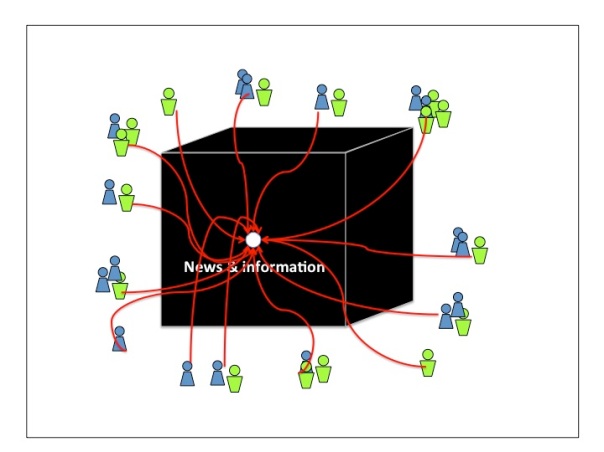

A visual rendering of the change in our world that’s destroying our old, keyhole-based business model.

1950s:

Today:

We’ve lost the keyhole effect. Now how do we attract an audience? A list of seven specific kinds of content that would draw like crazy.

We’ve lost the keyhole effect. Now how do we attract an audience? A list of seven specific kinds of content that would draw like crazy.

Everyday goal for media companies: Be the greatest show on earth

Everyday requirement for local media companies: Be the greatest show on earth

Now that we’re in competition with all the information available on the planet, we have to win our audiences every day by the value of what we offer them. So the job of the publisher, the editor and the VP of content/audience (if there is one) needs to be: Produce content throughout the day — every day — that no one can live without.

Seven kinds of “new news” for the 21st century

A deeper description of the seven kinds of content that would draw audience like crazy in any local market.

Part 1: The Mass Media bubble

My first explanation of the paradigm-shattering concept of “The Infinite Pipe.” This is one of three foundational posts from which virtually every other post in my five years of blogging is derived.

“The Infinite Pipe” — the history of human access to information over 200,000 years — reveals what’s happening to the entire mass-media business today, and why.

Part II — The end of the Mass Media era

What happens when information goes from limited to infinite? Five basic changes that are swamping the mass media businesses in a tsunami far larger than we can imagine.

Part III — What about news?

In this post, five years ago, I threw down the gauntlet for the first time:

“So it’s time for a fundamental awakening in local media businesses. We need to stop thinking of our communities as places where news happens and we report it. We need to start thinking of our communities as places where people lead their lives and we help them do it. We need to figure how to provide solutions they will regard as essential in their own lives and will use over and over every day. News has its place in this, but it’s a far bigger assignment than news.”

In conclusion

Folks, the game isn’t over. But we will continue to lose if we don’t wake up to the fact that we are responsible for producing content that works in today’s information systems, for people who are living today’s lives.

It’s change or die.

Family ownership — unique problems and solutions

Family ownership of a media company — or any other kind of company — can be a beautiful thing. But it has its own unique challenges and solutions.

Running or working for a media company presents plenty of challenges these days, as anyone in the business knows. But owning a media company adds even more issues, choices and decisions.

These can be immensely troubling and difficult, whether you’re a sole owner or a member of an owning family. If not handled well, these problems can compound the ordinary challenges.

They may even prove fatal to the business.

What kinds of issues? Here are just a few examples: Read the rest of this entry

Under summer’s spell

I’m on vacation in northern Michigan now, and I had intended to take a pass on writing for MediaReset.com this month, too.

But my mother and my wife changed my mind.

My mom brought to our vacation spot a copy of an editorial I wrote about 30 years ago while working at The Monroe (MI) Evening News — the paper our family owned at the time.

Mom pulls this piece out every August and makes me — and anyone else nearby — read it again.

This year, my wife was one of those. She read it and said, “You ought to publish this in your blog this month.”

So that’s what I’m doing. Read the rest of this entry

In a disrupted industry, how can you future-proof your career?

Here’s the plain truth: If you’re an early- or mid-career employee of a company that still depends heavily on print revenues, you need a plan.

Here’s the plain truth: If you’re an early- or mid-career employee of a company that still depends heavily on print revenues, you need a plan.

Jobs have been disappearing from these media companies at an alarming rate for more than a decade.

Print-based newspaper and magazine companies are fighting hard to replace declining print revenues with digital revenues and other business models. But very few — if any — are winning. The jobs keep going away. Read the rest of this entry

In Jacksonville, a new business model for the local editorial voice

Back in April, I lamented the steady decline in commitment to local editorials across the shrinking newspaper industry with this post: “Editorials: Headed for extinction?”

It’s a sad story. As ad revenues tumble and newsrooms shrink, so, too, are owners’ commitments to strong, impactful local comment in editorial pages.

Editorials lack any clear business model, so they’re vulnerable to cuts. Never mind that a strong, community-leading editorial voice can be a hallmark of our local brand and a reason we are seen as essential in the community.

In April, I hinted that I would blog on this subject again soon. One of the Morris publishers, Mark Nusbaum at the Florida Times-Union in Jacksonville, was working on an entirely new way to amplify his paper’s editorial voice and build a bold new business model around it. But it was still in development.

Last week it hit homes and businesses in Jacksonville. Read the rest of this entry

In the political fray, don’t guess at motives — debate the facts

Why did President Donald Trump dismiss FBI Director James Comey?

Why did Hillary Clinton operate a private email server when she was Secretary of State?

Why did FBI Director James Comey say the FBI wasn’t, and then was, continuing to investigate Clinton’s email practices?

What was Trump’s motive in announcing immigration bans on seven countries? Read the rest of this entry

Why the bitter U.S. political divide? Blame the digital information explosion

Most Americans would agree that our country is more fiercely divided along political lines today — Democrat/Republican and liberal/conservative — than ever before in our lives.

Most Americans would agree that our country is more fiercely divided along political lines today — Democrat/Republican and liberal/conservative — than ever before in our lives.

Through the last two or three presidential elections, this divide seems to have become more and more bitter. In the 2016 race, it reached a fever pitch, which has shown no sign of abating since the election of Donald Trump.

Power structure: Another “Big-J” project for strapped newsrooms (Part 2)

Last time I blogged about a fairly simple but powerful “Big J” journalism project we did years ago in my hometown, shaking up the judicial system in a very positive way.

Here’s another “Big J” project we did back then. It can be done in any community, and it will reveal very interesting things about who has and wields power in the community. Read further to learn how, and to see clippings of the stories we produced.

It started in 1992, when I was editor of my family’s newspaper in Monroe, Mich. At the time, I was doing some serious thinking about the local power structure. Read the rest of this entry

Editorials: Headed for extinction?

Mar 22

Posted by Steve Gray

Powerful local advocacy is essential to your news brand

Nobody seems to be noticing, and that’s a shame. In this and probably a future post, I intend to make the case for strong local opinion-writing as a key element of community journalism.

In the local media business, we like to think that our brand has immense value. I believe the thoughtfulness and impact of our editorials plays a huge part in creating that value. Read the rest of this entry →

Posted in Audience, Content, Disruption, innovation, Investigative reporting, Journalism, media management, media ownership, News, Newsrooms

3 Comments

Tags: commentary, Editorials